Irs car depreciation calculator

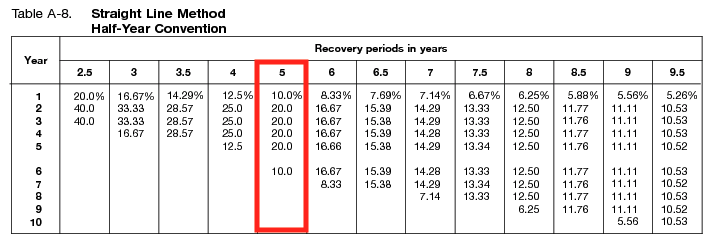

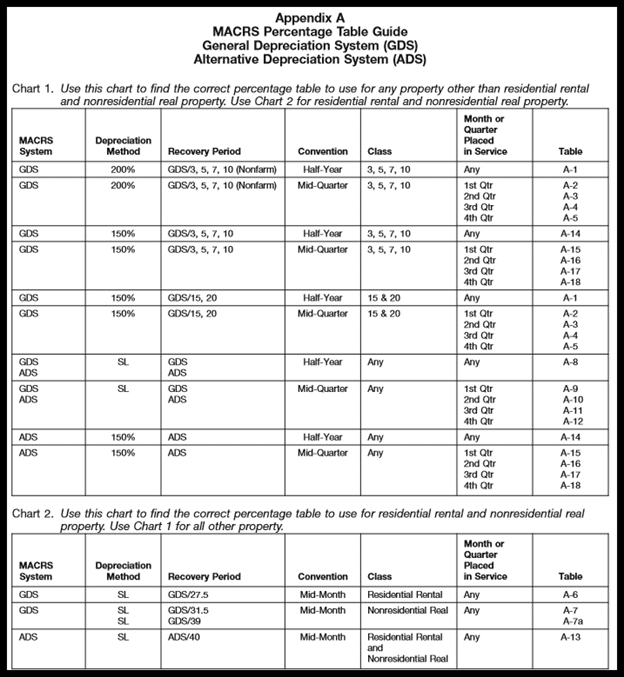

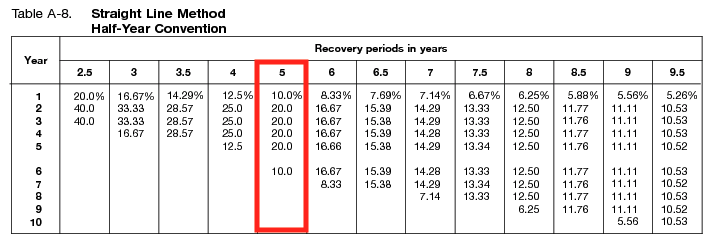

The standard mileage rate method or the actual expense method. The MACRS Depreciation Calculator uses the following basic formula.

Vehicle Tax Deductions Writing Off A Vehicle For Business Using Section 179 Depreciation Youtube

It takes the straight line declining balance or sum of the year digits method.

. SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. Also businesses with a net loss in a given tax year qualify to carry-forward the. Car Depreciation By Make and Model Calculator Find the depreciation of your car by selecting your make and model.

Work-related car expenses calculator. When its time to file your. For 6 months - 1 year old car the rate is 15.

The following calculator is for depreciation calculation in accounting. Cost x Days held 365 x 100 Effective. IRS Issues New 2022 Rules for Passenger Car Depreciation The IRS has provided updated tables containing.

Provide information on the. This limit is reduced by the amount by which the cost of. Our Car Depreciation Calculatorbelow will allow you to see the expected resale value of over 300 modelsfor the next decade.

Make the election under section 179 to expense certain property. If you are using the double declining. The Car Depreciation Calculator uses the following formulae.

So 11400 5 2280 annually. The calculator makes this calculation of course Asset Being Depreciated -. For 1-2 year old car the depreciation rate is 20.

Prime Cost Depreciation Method The Prime Cost method allocates the costs evenly over the years of ownership. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. We will even custom tailor the results based upon just a few of.

So if you purchased a car for 30000 and you want to know how much your new car will depreciate after five years here is how you would calculate the. Use Form 4562 to. Claim your deduction for depreciation and amortization.

This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. By entering a few details such as price vehicle age and usage and time of your ownership we. Likewise if the age of car is 3-4 years the rate of.

If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000. It can be used for the 201314 to. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly.

The depreciation is calculated by applying the vehicles depreciation rate average high or low and then adding the number of years you anticipate owning the vehicle. For 2-3 year old car the rate is 30. You can generally figure the amount of your deductible car expense by using one of two methods.

Depreciation deduction limits for passenger automobiles placed. Section 179 deduction dollar limits. Use this depreciation calculator to forecast the value loss for a new or used car.

Remember that residential rental. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000. This calculator may be.

You can then calculate the depreciation at any stage of. Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Irs vehicle depreciation calculator.

Example Calculation Using the Section 179 Calculator.

Macrs Depreciation Calculator Macrs Tables And How To Use

Macrs Depreciation Calculator

How To Calculate Macrs Depreciation When Why

How To Calculate Car And Truck Expenses And Depreciation For The Irs

2

Modified Accelerated Cost Recovery System Macrs A Guide

Car Depreciation Calculate New Vehicle Depreciation

How To Calculate Car And Truck Expenses And Depreciation For The Irs

Macrs Depreciation Calculator Straight Line Double Declining

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Macrs Depreciation Calculator Based On Irs Publication 946

How To Calculate Car And Truck Expenses And Depreciation For The Irs

Automobile And Taxi Depreciation Calculation Depreciation Guru

Irs Standard Mileage Rates For 2022 Nerdwallet

Macrs Depreciation Calculator Straight Line Double Declining

Deductible Mileage Rate For Business Driving Increases For 2022 Sol Schwartz

How To Calculate Car And Truck Expenses And Depreciation For The Irs